Debt Relief Will Reach 100,000 Households

- Total scope of the debt relief around ISK 150 billion.

- Will assist as many as 100,000 households.

- Average housing mortgage can decrease by around 20%.

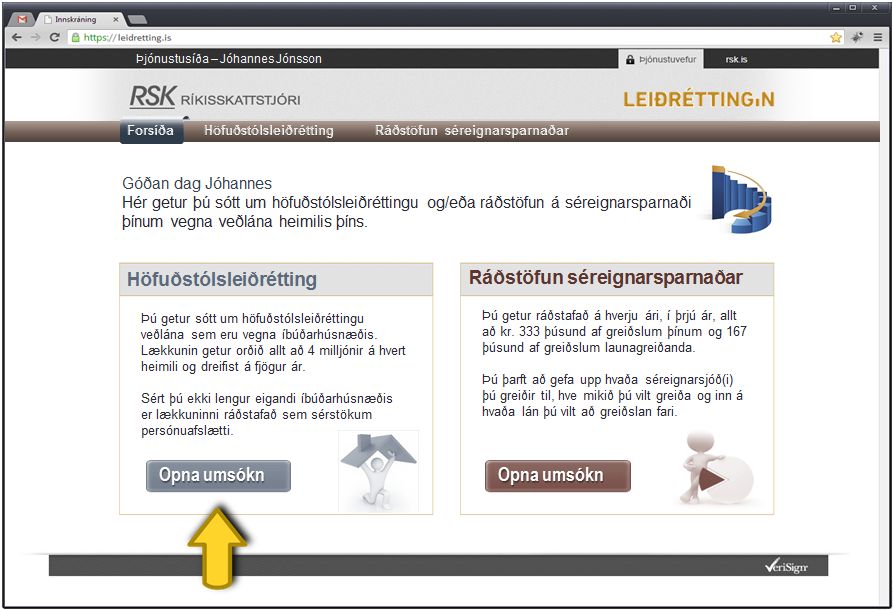

- Simple to apply for the debt relief on the website of the Directorate of Internal Revenue.

- Tax deduction granted on personal pension savings used for purchase of housing.

Today the Government is presenting to the Icelandic parliament Althingi two bills of legislation which will reduce household mortgage debt in Iceland and make it easier for first-time buyers to purchase housing. The first provides for an adjustment to the principal of inflation-indexed housing mortgages and the second for a tax deduction for private pension savings. The reduction will lighten households' debt service burden and boost their disposable income.

The total scope of the actions is estimated to amount to around ISK 150 billion, and to assist as many as 100,000 households. The combined impact of the actions could reduce the average housing mortgage by approximately 20% The Directorate of Internal Revenue handles the application process, which will be simple and accessible on the Directorate's website. Once the bills have been adopted by the Althingi it will be possible to submit applications.

New thinking in housing affairs

These actions will make it possible to apply private pension savings to reduce the mortgage principal; this route will be open to all holders of housing mortgage holders which convey the entitlement to interest benefits. People are also offered the possibility of utilising personal pension savings for real estate purchases with an accordant tax deduction; this will be a useful option, for example, for families in rental accommodations.

The reduction to the principal is expected to begin as soon as the deadline for application has passed.

Bill of legislation on debt relief for housing mortgages

The maximum amount of write-down to inflation-indexed housing mortgages will be ISK 4 million per household.Previous public remedies reducing the loan principal from which the borrower has benefited will be deducted from the amount of the adjustment. The right to debt relief arises from inflation-indexed mortgages for residential housing for own use, which serve as the base for interest benefits and existed during the period 1 January 2008 to 31 December 2009. The debt relief is on the initiative of the borrower, who must apply for it from the Directorate of Internal Revenue during the period from 15 May to 1 September 2014.

The bill discusses the arrangements for debt relief for individuals' inflation-indexed housing mortgages. It was prepared by a working group appointed by the Minister of Finance and Economic Affairs specifically to compile a draft of the necessary statutory amendments. The bill was drafted in close collaboration with the project management on reduction of the principal of housing mortgages and the consultation group on implementation of principal reduction.

The bill proposes that Althingi authorise the Minister to reach an agreement with pension funds, the Housing Financing Fund and financial undertakings on the implementation of general debt relief for inflation-indexed housing mortgages of individual which existed during the period 1 January 2008 to 31 December 2009.

Bill of legislation on personal pension savings and their use for payment of housing mortgages and for housing savings

The bill proposes amendments to Act No. 129/1997, on Mandatory Guarantee of Pension Rights and Operation of Pension Funds; Act No. 90/2003, on Income Tax; and Act No. 44/1998, on Housing Affairs.

In substance, the bill consists of two main proposals:

Firstly, it proposes a measure authorising families to use personal pension savings to repay loans taken out to acquire residential housing for own use. The requirement for doing so is that the loan is secured by a mortgage on residential property and that it serves as a basis for the calculation of interest benefits. This includes guarantor mortgages, if they fulfil the same requirements.

Secondly, it proposes a measure authorising the use of pension contributions, which have accumulated over a certain period, for purchase of residential housing for own use (housing savings).

In both cases this will be a temporary, tax-free measure for three years, in the case of payment/disposition of contributions towards a loan, and for five years, in the case of housing savings.

The basic requirements in both cases are these:

- Household: families and individuals.

- The property must be residential housing for own use.

- The period of validity is limited to pension contributions paid during the period 1 July 2014 to 30 June 2017.

- The maximum amount per year is a total of ISK 500,000 per family and property (a total of ISK 1.5 million over three years).

- The maximum contribution is 4% from the wage earner and 2% from the employer.

- The individual saves at least 2%, or the equivalent of the employer's contribution, if it is lower than 2%.

For further information contact:

Sigurður Már Jónsson, the Government's Press Secretary, GSM +354 893-1046

Tryggvi Þór Herbertsson, project manager, GSM +354 844-7035

Elva Björk Sverrisdóttir, Press Officer of the Ministry of Finance and Economic Affairs, GSM +354 693-4747

26.03.2014

Prime Minister's Office Ministry of Finance and Economic Affairs